The most strategic way to achieve steady returns with low risk is to park your funds in debt mutual funds. Compared with equity funds, debt mutual funds work the best as it invest in government-backed fixed-income securities. But, if you are looking to optimize your returns, you need to understand how these funds work and their settlement process.

In today’s KOFFi break, we will understand NAV (Net Asset Value), the debt funds settlement process, the NAV allocation process, and everything related to NAV.

Understanding Net Asset Value (NAV)

Introduction to Debt Funds

Debt funds invest primarily in fixed-income securities such as government bonds, corporate bonds, treasury bills, and other money market instruments. The value of these investments is represented by the Net Asset Value (NAV).

NAV is the per-unit price of the fund. It is calculated on a daily basis and reflects the market value of the securities in the portfolio after deducting expenses and liabilities.

NAV plays an important role in knowing the value of your investments. When you invest in a debt fund, you buy some units of the funds at the NAV of that particular transaction date.

What is the Debt Funds Settlement Process?

Debt fund settlement is a process through which the buyer receives units of the fund in exchange for their investment, while the funds are transferred to the debt fund’s pool for further investments in debt securities.

When an investor redeems their units, they receive the current value based on the Net Asset Value (NAV) from the fund itself.

These two processes are carried out on T+1 Day(transaction date plus one working day). This is the core clearing and settlement process in a stock exchange.

As per SEBI’s announcement in January 2023, the settlement cycle of all F&O equities and remaining stocks will shift from the T+2 Settlement Cycle to the T+1 Settlement Cycle. This will make the process faster and reduce risks.

SEBI also plans to move to a T+0 Settlement Cycle in the future, which means settlements could happen on the same day, making the system even more efficient.

Important things to note:

- T-Day (Transaction Day): The day you submit your investment or redemption request.

- T+1 Day: The next working day when the transaction is processed, and units are allotted or redeemed.

What is the Cut-off Time?

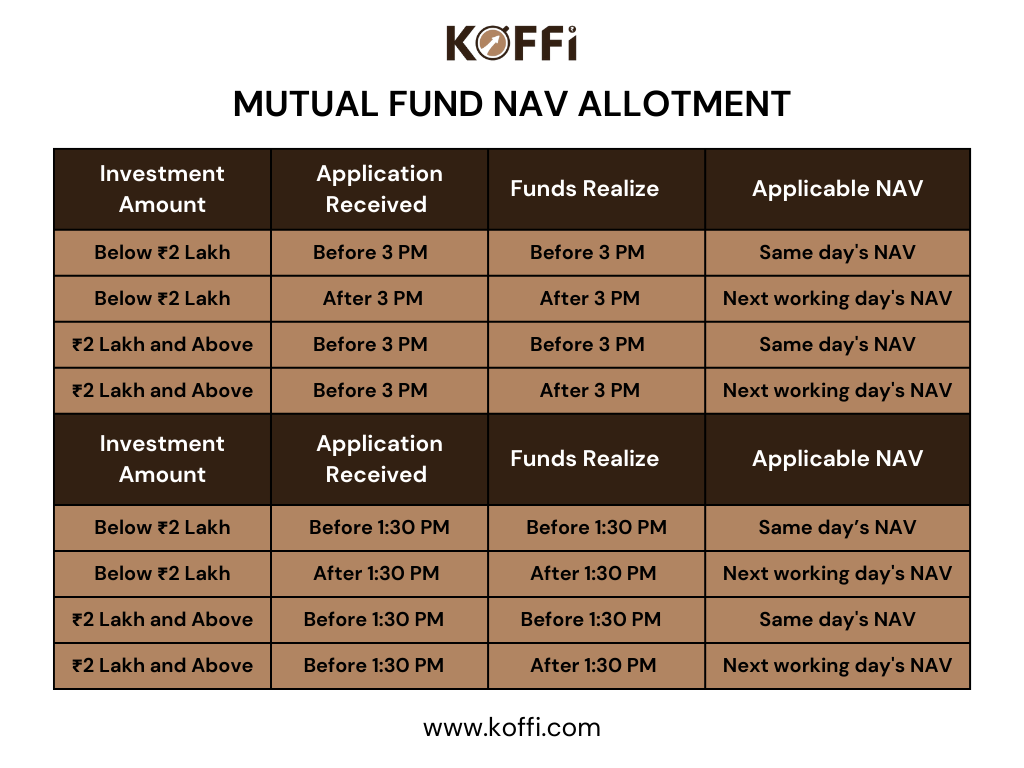

The cut-off time is crucial in determining which day’s NAV you receive for your investment. For debt funds, the cut-off time is 3 PM on a working day.

For Investments Below ₹2 Lakh:

- Application and Funds Before 3 PM: You receive the same day’s NAV.

- Application or Funds After 3 PM: You receive the next working day’s NAV.

For Investments of ₹2 Lakh and Above:

- NAV is allotted based on when both the application is received and the funds are credited to the fund’s bank account, regardless of the submission time.

- If funds are realized before 3 PM: You receive the same day’s NAV.

- If funds are realized after 3 PM: You receive the next working day’s NAV.

How is NAV Allotted in Debt Funds?

NAV allotment in debt funds is not as straightforward as in equity funds. It varies depending on:

Type of Debt Fund:

- Liquid and Overnight Funds: These funds have unique NAV allotment rules due to their high liquidity and short-term nature.

- Other Debt Funds: Standard debt funds follow different NAV applicability norms.

Transaction Timing:

- The time at which the investment application is submitted relative to the fund’s cut-off time is crucial.

Fund Realization:

- The date and time when the mutual fund receives the investment amount in its bank account determine the applicable NAV.

Here’s the step-wise process for NAV allocation:

- Investment Request Submitted: You place an order to invest in a debt fund through your broker or directly with the fund house.

- Payment Processed: Your payment is initiated and needs to be credited to the mutual fund’s bank account.

- Fund Realization: The fund house confirms receipt of your investment amount.

- NAV Determined: Based on the cut-off time and when funds are realized, the applicable NAV is determined.

- Units Allotted: Units are allocated to your account and will reflect in your portfolio accordingly.

Formula for NAV Calculation:

NAV = (Total Assets – Total Liabilities)

Numbers of Units Outstanding

- Total Assets: The current market value of all the securities (like bonds, and treasury bills) held by the fund, plus any cash or receivables.

- Total Liabilities: Expenses such as management fees, operational costs, and other payables.

- Number of Units Outstanding: The total number of units issued by the fund.

The NAV is typically calculated daily based on the market values of the fund’s portfolio.

For example:

- If the investment amount is less than ₹2 lakh and the application is submitted before the cut-off time with realized funds, you get the same day’s NAV.

- For amounts equal to or greater than ₹2 lakh, the NAV is allotted based on when the funds are credited to the scheme’s bank account, regardless of the time of application submission.

NAV Applicability for Liquid and Overnight Funds:

- Cut-off Time: Typically, the cut-off time for liquid and overnight funds is 1:30 PM.

- NAV Applicability:

- If the application and funds are received before the cut-off time, the NAV of the previous day is applied.

- For applications received after the cut-off time, the NAV of the day before the next business day is applicable.

This distinction is crucial for large investments, as the NAV can fluctuate based on market conditions.

Reasons for the Changing NAV of Debt Funds

There are various reasons that affects the change of NAV of debt funds:

- Interest Rate Movements: Changes in interest rates directly affect the prices of bonds, which in turn impact the NAV.

- Credit Ratings: A change in the credit rating of the securities in the portfolio can affect their value and the NAV.

- Market Conditions: Economic factors, inflation rates, and liquidity in the market can fluctuate the NAV.

- Duration of Securities Type: Gilt funds with longer maturities are more sensitive to interest rate changes, leading to greater NAV volatility. Shorter-duration overnight funds are less affected, resulting in a more stable NAV.

Before parking your funds, it’s important to understand the market conditions and other crucial factors.

Good Practices to Make the Best of Settlement Time and NAV Allocation

Here is a list of good practices that can maximize your returns from your debt fund investments:

- Plan Ahead: Be aware of the cut-off times. Ensure your funds are cleared and credited to the fund’s bank account before making large investments.

- Monitor Interest Rates: Keep an eye on interest rate trends. Interest rates significantly impact the NAV of debt funds.

- Avoid Last-Minute Transactions: Last-minute investments can result in missing the desired NAV. Do every transaction after doing the appropriate research and considering all.

- Check for Holidays: Be mindful of bank and market holidays that might impact transaction processing times.

- Use Fast Payment Methods: Prefer methods like online transfers over cheques, which can take longer to process.

Conclusion

Understanding the settlement process and NAV allotment in debt funds is crucial for any investor to optimize and maximize returns. Be mindful of the cut-off times, the NAV allotment criteria, and the factors that influence NAV. Make informed decisions to align your investments with your financial goals.

FAQs on NAV Allocation and Debt Settlement Process

1. What happens if I miss the cut-off time by a few minutes?

If you miss the cut-off time by a few minutes, your transaction will be processed based on the NAV of the next working day. This can impact the value of your investment, especially in a volatile market.

2. Does the NAV change on non-working days?

No, the NAV does not change on non-working days such as weekends or public holidays. NAV is only calculated and published on working days when the markets are open.

3. How does the settlement cycle of debt funds differ from equity funds?

Both debt and equity mutual funds typically follow a T+1 settlement cycle, where transactions are settled on the next working day. However, the actual credit of redemption proceeds may vary depending on the fund house and the type of scheme. It’s always best to check with the specific fund for precise details.

4. Can I choose the NAV that I want for my transaction?

No, you cannot choose the NAV on your own. The NAV allotted to your transaction depends on the time of your request, the cut-off time, and when the funds are realized in the scheme’s account.

5. What should I do if my transaction was delayed due to bank processing times?

If your transaction was delayed due to bank processing times and you missed the cut-off time, you would receive the next applicable NAV. To avoid this, try to initiate transactions early in the day and check with your bank about their processing times.

Was this helpful?

Click on a star to rate it!

As you found this post useful...

Follow us on social media!

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Ask us Anything!

Ask us Anything!