Introduction to Inflation

Inflation is a rate of increase in prices of goods and services over a period of time. It results in a decrease in the purchasing power of money. In simple terms, whenever inflation occurs, you can buy less goods and services with the same amount of money.

In India and the majority of the world, Inflation is measured using the Consumer Price Index (CPI) number.

The CPI tracks the prices of a basket of consumer goods and services over time, including food, housing, and transportation. It provides a concrete measure of inflation that reflects the cost of living.

The CPI is published monthly by the Ministry of Statistics and Programme Implementation and serves as a key indicator for policymakers and economists. Accordingly, economists and policymakers mend the economic policies.

Impact of Inflation on Savings

Whenever inflation rises, the value of money decreases. This impacts negatively on the people who are saving their money in banks.

Let’s take an example, assume you have ₹1,00,000 in a savings account, earning a mere annual interest rate of 4%, and the annual inflation rate is 6%.

Your value of money is diminishing over time. After one year, while your savings would grow to ₹1,04,000, the effective value of that amount, adjusted after inflation would be approximately ₹98,113.

Example with Calculations

- Initial Savings: ₹1,00,000

- Interest Earned: ₹1,00,000 * 4% = ₹4,000

- Total Savings after Interest: ₹1,04,000

Due to 6% inflation rate:

- Value Lost to Inflation: ₹1,04,000 * 6% = ₹6,240

- Real Value of Savings: ₹1,04,000 – ₹6,240 = ₹97,760

Despite earning interest, the real value of your savings has decreased by ₹2,000 over the year. Clearly, standard bank accounts and even some fixed deposits offer interest rates that barely keep up with or fall short of the inflation rate.

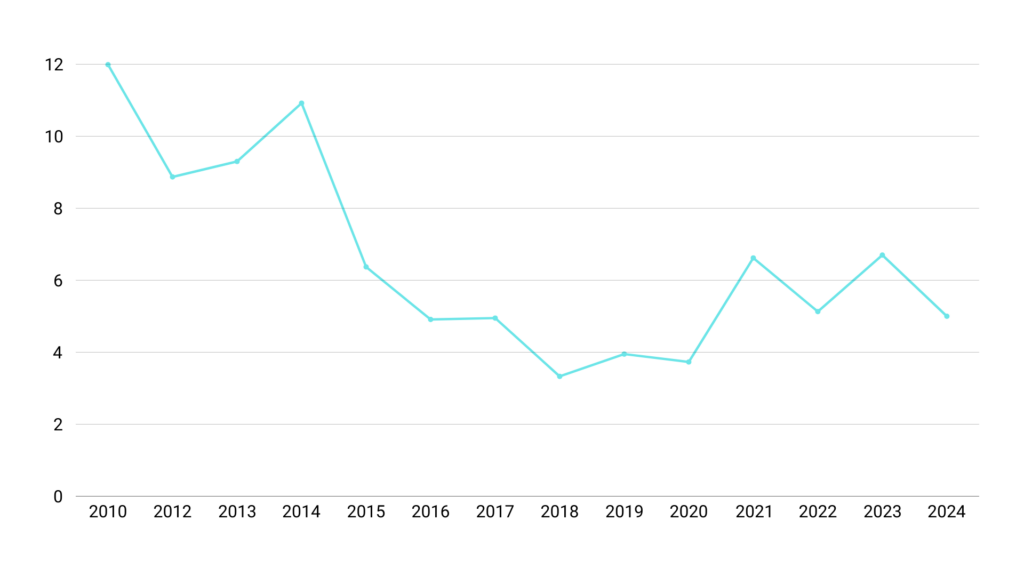

Historical Perspective Regarding Inflation

Over the last decade, India has experienced a great variation in inflation rates. During the 2010s, inflation rates were above 10%, which majorly impacted the purchasing power of savings.

For the last few years, inflation has fluctuated around 4-6%. After looking at these numbers, you should have an appropriate savings plan to grow your wealth.

Let’s look at historical inflation rates in India from the last 1 decade:

If you check the above inflation numbers, it is clearly visible that inflation is outpacing the interest rates offered by traditional savings accounts.

Common Misconceptions about Inflation

There are several misconceptions about inflation that need addressing:

- Inflation is Bad for Below Middle-Class Citizens: Obviously, higher inflation will erode your savings but moderate inflation is a sign of a growing economy. Excessive inflation or hyperinflation can be harmful.

- Savings Are Safe from Inflation: Many citizens of India believe that saving money is safe. It is important to understand that the interest rate of a traditional savings account is less than inflation rates.

- Fixed Deposits Are Inflation-Proof: There are fixed deposits with higher interest rates, but many times inflation beats them. Especially after taxes, higher interest rates of fixed deposits fall short in front of inflation.

- Investing is too risky: Due to risks in investments, many citizens avoid parking money in various safe funds. Few safe and low-risk investment options can provide returns that surpass inflation. It makes them essential for long-term financial health.

Strategies to Beat Inflation

The main problem that we are solving is to find options that beat inflation. To protect your savings from inflation, consider parking your funds in investment options that offer returns higher than traditional savings account interest rates. Here are a few options:

- Debt Funds: These funds invest in bonds and other debt securities and offer higher returns than savings accounts.

- Arbitrage Funds: These funds exploit price differences in different markets, providing potentially higher returns with relatively low risk.

- Treasury Bills: Short-term government securities are secure and safe options that offer returns higher than savings account rates.

- Money Market Instruments: These include certificates of deposit (CDs), commercial paper, and other short-term securities with competitive returns.

Practical Steps to Protect Your Money

Efficient fund parking is mandatory. Here are some practical steps to protect your money:

- Diversify Investments:

- Don’t park your entire money in one type of account or investment.

- You can spread your investments across various asset classes, such as equities, real estate, and commodities, to decrease risk and enhance returns.

- Regularly Review and Adjust:

- Keep a continuous eye on inflation and adjust your savings strategy accordingly.

- Check the changing inflation rates and plan your investment strategies as per your personal financial goals.

- Invest in Inflation-Protected Securities: Instruments like Treasury Inflation-Protected Securities (TIPS) are designed to protect your investments from inflation.

- Stay invested for the long term: There is huge power in long-term market participation. Investing for more than 15 to 20 years can beat the inflation rate of 6-7% annually.

- Diversify Investments:

Final Thoughts

Inflation impacts the most on one who saves the money in savings accounts. You should park your savings money in some or the other options which can potentially surpass the inflation rate. You can safeguard your financial future if you follow the above tips and strategies. Stay informed and proactive about your savings and investment choices. Make sure your money should retain its value over time.

Was this helpful?

Click on a star to rate it!

As you found this post useful...

Follow us on social media!

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Ask us Anything!

Ask us Anything!