You might have heard that you can easily earn up to 7-8% interest on your regular bank account. All you need to do is set up an Auto Sweep Facility in your bank account.

That’s too lucrative, right? But wait there’s more something you need to know. What if I tell you, you could end up earning even lower interest than your regular bank account with an Auto Sweep Facility?

In today’s episode of KOFFi break. Let’s try to understand the real mechanism of the Auto Sweep Facility.

What is an Auto Sweep Facility?

An Auto sweep facility is just like normal fixed deposits that allow you to earn higher interest rates on your surplus money in your bank account with some additional benefits like liquidity and fixed deposit interest rates on your bank accounts.

Let’s Try to Understand How They Work

Auto sweep facility is linked to your bank accounts where you will set a minimum balance to be retained in your bank account, which acts as a threshold.

So every time whenever more money is credited to your bank account, which is above this threshold (generally in multiples of 1000s) it will be directly swept into fixed deposit and a new FD will be created on that excess amount, on which the bank will provide you fixed deposit interest rates.

Here’s an example to understand this better:

- Let’s say, you set up the auto sweep facility in your savings bank account, with a minimum balance of Rs 10,000/-.

- That means any money credited above Rs 10,000/-, will be directly swept into a new FD.

- Now, let’s say an additional Rs 5,000/- is credited to your bank account after this Rs 10,000/-. The bank will then sweep this surplus of Rs 5,000/- into a new FD and begin paying FD interest rates on it.

- If another Rs 10,000/- is credited to your bank account after this Rs 5,000/-, the bank will sweep this Rs 10,000/- into a new FD and start paying interest on it.

But what if I need this money?

- If you need to withdraw 12,000/- from your bank account. Then 10,000/- will be withdrawn first from the minimum balance and 2000/- from the auto sweep FD.

- Then the bank will wait for you to fulfil the minimum balance in your bank account again to touch that threshold.

- After reaching the minimum balance requirement your bank resumes to sweep surplus money into new FDs.

Then What’s Wrong with Auto Sweep Facility?

Major banks in India, including ICICI, SBI, HDFC, and Axis Bank offer an average interest rate of 2-4% on their savings accounts. Therefore, the 7-8% interest rate in an Auto Sweep Facility bank account easily attracts those looking to park idle funds safely.

However, you need to understand the difference between the advertised returns and the actual returns.

Let’s break it down:

- Whenever you activate an auto sweep facility in your bank account, it usually comes with a fixed tenure, although some banks allow you to choose the tenure.

- Generally, the tenure lasts one year. This simple tenure is similar to the duration of your normal FD, during which you must keep your money untouched.

- But if I need my money and want to withdraw it before my tenure ends, what will happen? Your bank will charge you a penalty that varies between 0.5-1%.

We will discuss this premature withdrawal penalty in further detail as it becomes an actual pain.

Do you remember the previous example, where you needed to withdraw 12,000/- rupees from your savings account? So, do you have any questions about how the bank will calculate interest on the 2,000 rupees you withdraw from the auto sweep FD?

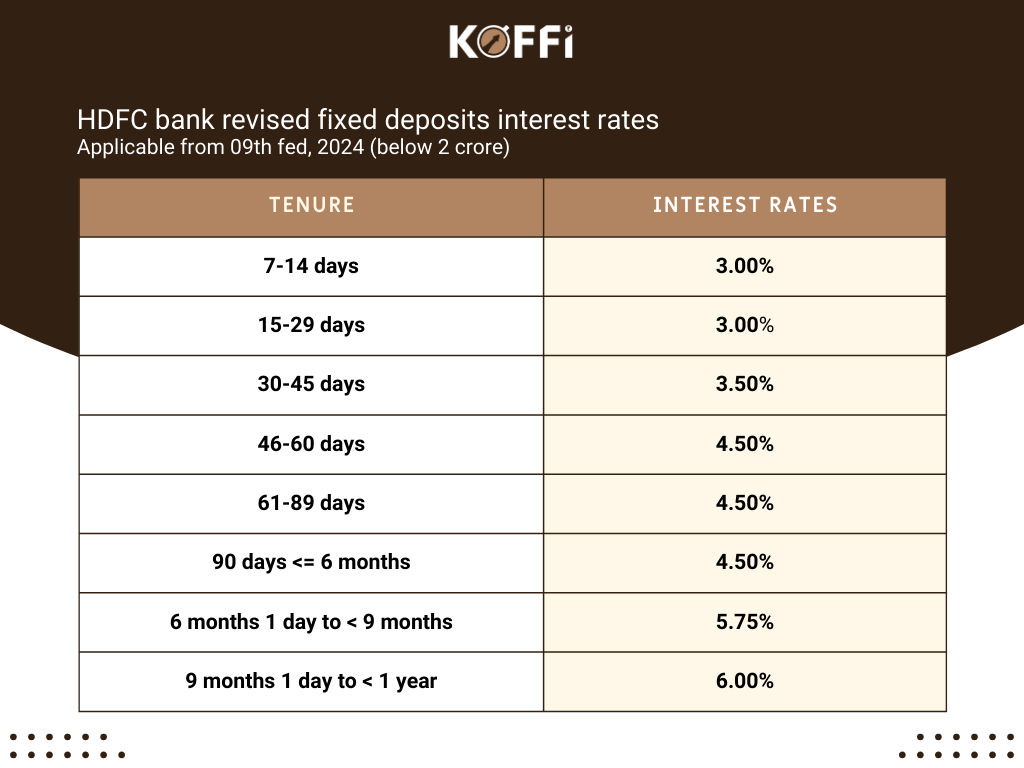

If yes, great! You are on the right track! Let’s try to understand how the bank calculates interest on those 2,000/- rupees and also what actual interest you will gain from the auto sweep facility, using a real-life example from HDFC Bank.

- HDFC Bank offers a 3% annual interest rate on their savings account.

- If you avail of the auto sweep facility in your HDFC bank savings account, you will receive about 6% annual interest on your surplus balance, provided you do not touch your money for a year.

- So, if you withdraw 2,000 rupees from your auto sweep FD 42 days after creating your first auto sweep FD, the bank calculates interest on your money as follows:

Particular | Amount |

FD interest rate as of 42nd day | 3.50% |

Premature Withdrawal Penalty (minus) Total Rate of Interest | -1% 2.50% |

You will receive net interest of 2.50% on your 2,000 rupees, which is even less than what the savings account offers.

Here, you can see the difference between the advertised interest rate and the actual interest rates you will receive in the auto sweep facility. Sometimes, the interest rates you hear about might not be what you receive.

But, Auto Sweep Facility has Good Features too

- High-Interest Rates on Bank Accounts: You can directly earn higher interest rates on your bank account with the auto sweep facility.

- Liquidity: You maintain liquidity similar to a savings or current account, along with receiving higher interest rates of FDs.

- Flexibility: You can set minimum balance requirements in your bank account and choose the fixed deposit tenure, as many banks offer this flexibility.

Limitations and Drawbacks of Auto Sweep Facility

- Frequent Transaction: Frequent transactions in the account can reduce interest rates and work against you.

- Minimum Balance: Only amounts exceeding the minimum balance sweep into FDs, requiring you to maintain a minimum balance.

- Tax: You receive up to 10,000/- in tax deductions under 80 TTA for interest income from a savings account, but FDs do not offer this benefit.

- Tax Liability: You must pay tax according to your income tax slab (10%, 20%, 30%), which will significantly impact your capital gains.

Who Should Consider Using an Auto Sweep Facility?

- Businesses: Auto sweep facility could be beneficial for business. Businesses don’t have access to savings accounts to park their idle funds where they can get some interest along with liquidity. So they could avail sweep-in facility in their current account.

- So even through frequent transactions, they could make some interest income as they earn zero interest from their current account.

- Financially disciplined people: People with surplus money and low frequency of transactions are perfect for auto sweep facility so they could earn higher interest on savings accounts.

Final Thought

Auto sweep facilities become the smart choice when you understand how they work and use them correctly. They enable you to earn more while still having access to your money when needed. Consider how frequently you need to access your bank account. If you rarely need to touch your money, using an auto sweep facility might be an effortless way to earn extra.

Did you find this information valuable? Share this blog with someone who actively uses the auto sweep facility or is planning to start. Help them make informed financial decisions just as you do!

Don’t forget to subscribe to our blog for more valuable insights. For additional learning and daily financial wisdom, follow us on our social media handles. Stay connected and stay informed!

Note:

- Kotak Mahindra does not impose penalties on premature withdrawals from sweep-in accounts.

- However, HDFC does charge penalties on premature withdrawals in sweep-ins.

- AXIS Bank imposes conditions on charging penalties. If your withdrawal amount exceeds 25% of the deposit’s original value, they apply a Premature Closure Penalty Rate to the entire withdrawal amount.

Was this helpful?

Click on a star to rate it!

As you found this post useful...

Follow us on social media!

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Ask us Anything!

Ask us Anything!