As a business owner, one of your objectives would be to optimize your company’s liquidity and maximize returns on the surplus funds. For the same, you would be navigating into the world of financial instruments.

In today’s KOFFi break, let’s find a different alternative for business owners to optimize profit on their surplus funds. Here we will introduce you to Money Market Accounts and Money Market Funds.

What is a Money Market Account (MMA)?

Money market accounts(MMA), aka money market deposit accounts (MMDA), are high-interest-bearing deposit accounts offered by banks and credit unions on your funds.

They are a type of savings account that offers higher interest rates to customers who deposit large amounts of money. Unlike the market, MMA offers stable interest rates to help you grow your money.

MMA is a combination of savings and Current accounts and hence offers benefits for both accounts.

Are you excited to know how MMA is beneficial for your business? Read further.

Money Market Accounts as a Global Phenomenon

Money market accounts are a powerhouse for business cash flow. Businesses worldwide prefer MMAs because of their varied features like liquidity, high-interest yield, safety, etc.

Here are the several benefits of MMA which make it a global phenomenon for SMEs:

1. Better Cash Flow Management:

- Every business needs help with cash flow management. MMAs provide some returns on idle funds stored in your bank account throughout the month.

2. Insured Capital Preservation:

- Funds in money market accounts are protected from market losses and gain a higher interest rate than savings and Current accounts.

- These funds are also authorised by insurance corporations.

3. More liquidity:

- Business profits invested in stocks, mutual funds, bonds, real estate, etc, are not accessed simultaneously or even on the same day.

- In MMAs, you get greater access to funds (whenever and wherever needed) with various options, such as debit cards, checks, bank visits, etc.

4. Unlimited Deposits:

- Daily cash businesses get the most significant benefit of unlimited deposits.

- Apart from unlimited deposits, there are limited withdrawals of 6 per month.

5. Better Seasonal Fluctuation Management:

- Many businesses face unpredictable situations with seasonal fluctuations. MMAs are crucial in saving excess funds at peak seasons and gaining interest rates.

- This buffer money can help businesses in unfavorable phases and eventually help ensure healthy cash flow throughout the year

Features of Money Market Accounts Work?

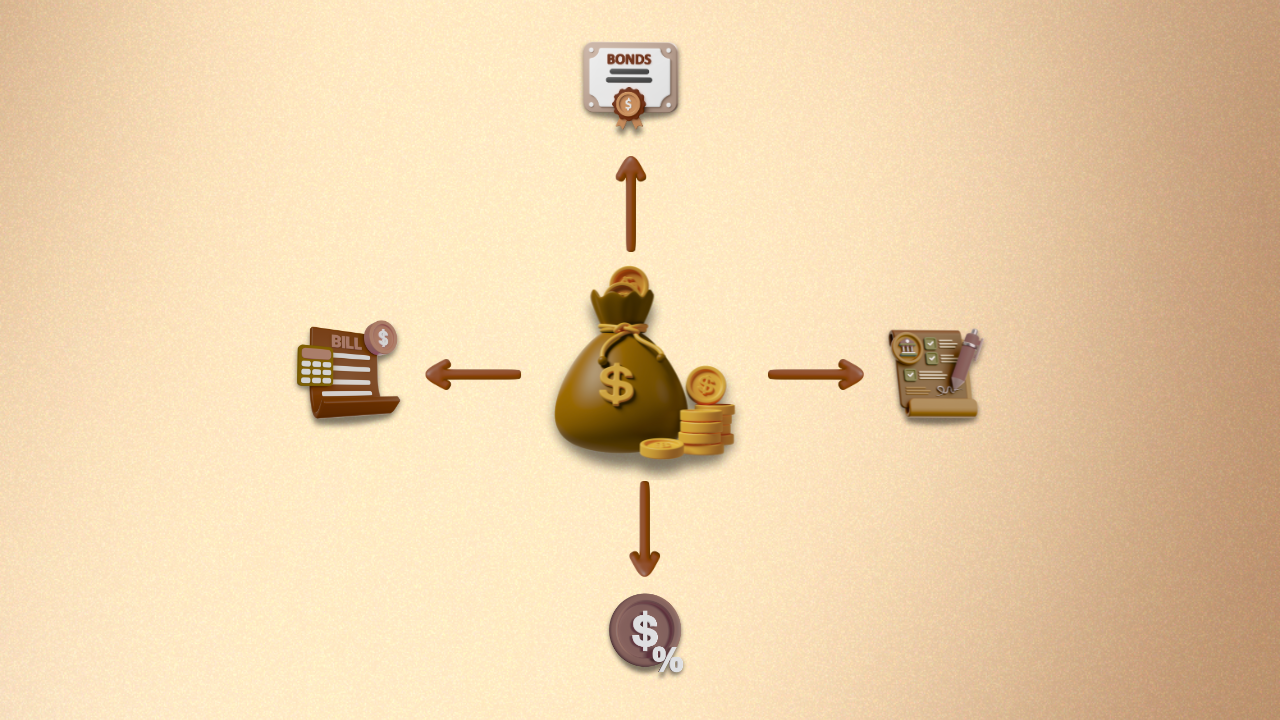

[Money Market Account = Savings Accounts + Current Accounts]

Money market accounts offer the best features for businesses because they combine savings and current accounts. Let’s understand how MMAs work and why they fit your business well.

Features of Money Market Account | Description |

Deposits |

|

Interest |

|

Access to your Funds |

|

Withdrawal Limitations |

|

Short-term Fund Savings Option |

|

Note:

- A minimum initial deposit is required when opening a money market account.

- You’ll have to maintain the balance until the account is active. The bank may inflict a service charge if the balance falls below a minimum amount.

Banks invest funds from money market accounts into very low-risk assets such as commercial papers, treasury bills, and government securities. These investments generate higher returns to the banks which are then passed on to money market account holders through higher interest rates.

Money market accounts also require higher minimum balances to open and operate the account which allows banks to invest more funds in these very low-risk assets.

Not only this, money market accounts are designed to discourage frequent withdrawals by limited transactions, which helps banks maintain liquidity.

Due to this banks are able to provide higher interest rates on money market accounts, which is not possible in the case of current accounts due to their unlimited transaction flexibility and very low or zero minimum balance requirements.

How MMA is different than treasury platform for corporates

Let’s understand, what are the key differences between money market accounts and treasury platforms:

Criteria | MMA | Treasury Platform |

Investment Options |

|

|

Suitable Segment |

|

|

Minimum Balance Requirements |

|

|

Liquidity |

|

|

Management Expertise |

|

|

Fees |

|

|

Absence of Money Market Accounts in India

A necessary prerequisite for a country’s money market is the effective implementation of monetary policies. So when you ask, “Why is MMA not prominent in India?”

The answer is simple, India lags in the implementation of monetary policies which makes the Indian money market relatively underdeveloped compared to advanced countries like the UK and the USA.

Liquidity anomalies, lack of capital, and nonuniformity in interest rates were the major issues for the underdeveloped Indian money market. The RBI consistently making moves to control these issues but it’s still a long journey.

Because of these reasons, India is not able to adopt a money market account. But now you might be thinking, where is India focusing?

If not Money Market Accounts, where is India focusing?

Rather than money market accounts, India focuses primarily on Money Market Funds. Let’s understand in short, what money market funds are.

Money market funds or money market mutual funds are like short-term debt funds for investing. The money is invested in various money market instruments by offering good returns. Money market funds are stable with good liquidity and security. Here you can access your cash within a year.

The major difference between Money Market Accounts(MMA) and Money Market Funds(MMF) is:

Feature | Money Market Account (MMA) | Money Market Fund (MMF) |

Interest Rates | Moderate | Potentially higher |

Liquidity | High | High |

Safety | FDIC/NCUA insured | Not insured, but low risk |

Minimum Balance | Often high | Varies, but often lower |

Accessibility | Check-writing, ATM, debit card | Requires redemption of shares |

Transaction Limitations | Limited number per month | No limit |

Risk | Very low (insured) | Low, but not zero (not insured) |

Here’s the list of money market instruments where your money market funds are invested:

- Treasury Bills or T-Bills

- Certificate of Deposit (CD)

- Commercial Paper (CP)

- Repurchase Agreements

- Banker’s Acceptance

Final Thoughts

In conclusion, money market accounts (MMAs) are the best options for business cash flow management because of their business-focused advantages. Currently, India lacks MMAs, but after gaining maturity and evolving banking facilities in the country, MMAs would be a game-changer.

Businesses should explore all the investment options to optimize cash flow management and achieve the economic goal of their business.

Did you find this information valuable? Don’t forget to subscribe to our blog for more valuable insights.

Was this helpful?

Click on a star to rate it!

As you found this post useful...

Follow us on social media!

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Ask us Anything!

Ask us Anything!