Equity markets are volatile for short-term fund parking and business owners are consistently looking for stable instruments to keep their money safe and also get good returns on it.

But, what if I said in this volatile market, there is a hybrid instrument that gives you steady capital appreciation for your parked funds?

In today’s KOFFi break, we will learn how you can get steady capital appreciation despite the volatility of the security market with Arbitrage funds.

What are Arbitrage Funds?

The Arbitrage Mutual fund is a type of fund that takes advantage of the price difference of the same asset in different markets. These funds instantaneously buy assets at lower prices in one market and sell them for a higher price in another market.

Thus, the main purpose of Arbitrage Funds is to make a profit by frequently buying/selling assets in two different markets primarily in the Cash and Derivative markets.

What is the Cash Market?

The cash market, also known as the regular or spot market, is like a marketplace where you can buy and sell assets like stock and bonds and get them right away. Whenever you buy something here, you pay for it and you will have ownership of it immediately.

Think of the cash market like a grocery store. When you buy something, like apples, you pay for it and take it home right away. It’s the same with buying stocks or bonds in the cash market. You pay and own them immediately.

What is a Derivative Market?

The derivative market is also known as the F/O market (Futures and Options). A derivative market is like a marketplace, where you don’t buy and sell actual assets like stocks or bonds, instead, you deal with contracts whose value links with these assets. These contracts are called derivatives.

Let’s imagine you’re at a market. While roaming around, you find apples being sold at a very low price and think this is a good opportunity to buy. However, you don’t really need those apples at the moment, yet you don’t want to miss this opportunity either.

So, you make a deal with the seller to buy the apples at this fixed price next month by paying a small amount in advance.

This is similar to the derivative market, where people agree to buy or sell things like stocks in the future at a price they decide now. They trade these promises, not the actual stocks.

How Arbitrage Funds Work

Now, you know that Arbitrage funds capitalise on price differences in various markets, primarily in cash and derivative markets. Let’s try to understand how they work by taking a simple example:

- Let’s say a company’s stock is traded at Rs 100 in the cash market and at Rs 140 in the futures market, expiring in one month.

- So, the fund manager will buy shares at the price of Rs 100/- from the cash market and sell them over in the futures market for Rs 140/-.

- After one month, if there is no change in the stock price in both markets, the fund will round off this trade by selling stock in the cash market for Rs 100/- and buying back from the futures market for Rs 140/-.

- This would successfully yield a profit of Rs 40 per share (Rs 140 – Rs 100).

This is how Arbitrage Funds work. But do you remember that I told you previously volatility is a friend of Arbitrage funds?

Let’s Try to Understand

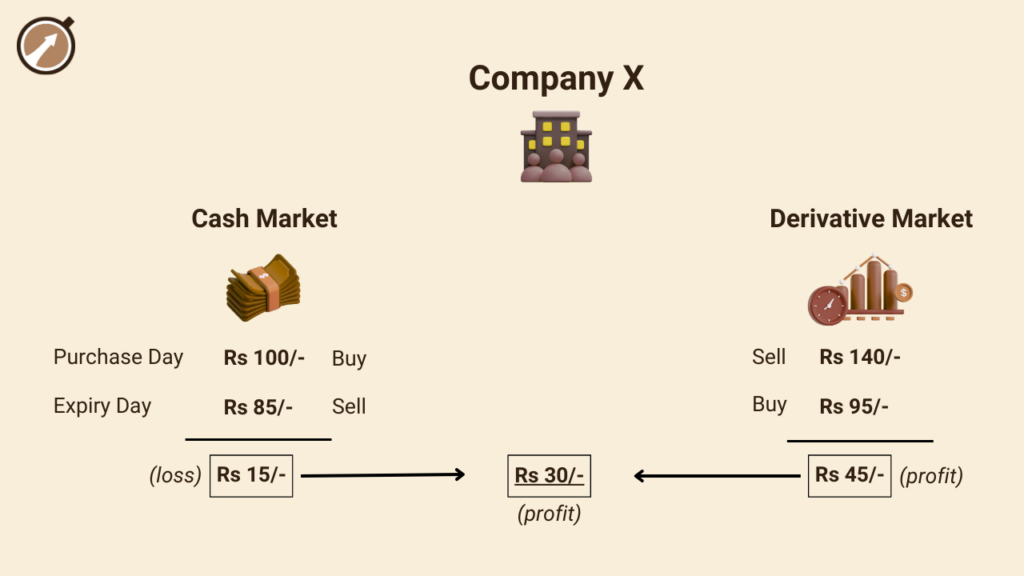

- Continuing with the example above, let’s assume that due to market volatility, the price of the stock falls to Rs 85 in the cash market and Rs 95 in the futures market after one month.

- So, what will happen this time? If this scenario occurred in any other equity fund, there would surely be a loss to bear, affecting the fund’s returns. However, this is not the case with Arbitrage Funds.

- After one month, the fund will sell the share in the cash market for Rs 85/- that they bought at the start of the month for Rs 100/-. Here the fund has to bear a loss of Rs 15/- per share (Rs 100 – Rs 85).

- Subsequently, the fund will buy back the shares from the futures market for Rs 95/- that they sell for Rs 140/- at the start of the month. Here the fund has enjoyed a profit of Rs 45/- per share (Rs 140 – Rs 95).

- Through this trade, the fund ultimately made a profit of Rs 30 per share (Rs 45 profit from the futures market minus Rs 15 loss from the cash market).

This method is also called Cash-And-Carry Arbitrage. This is the most common method used by Arbitrage Funds.

Particular | Transaction | Amount |

Price in the cash market | Buy | 100/- Per Share |

Price in the future market | Sell | 140/- Per Share |

Profit on the expiry date | – | 40/- Per Share |

If the price changes on the expiry date | ||

Price in the cash market | Sell | 85/- Per Share |

Price in the future market | Buy | 95/- Per Share |

Profit on expiry date | – | 45/- per share |

There are several other methods also used by these funds like Exchange Arbitrage.

What is Exchange Arbitrage?

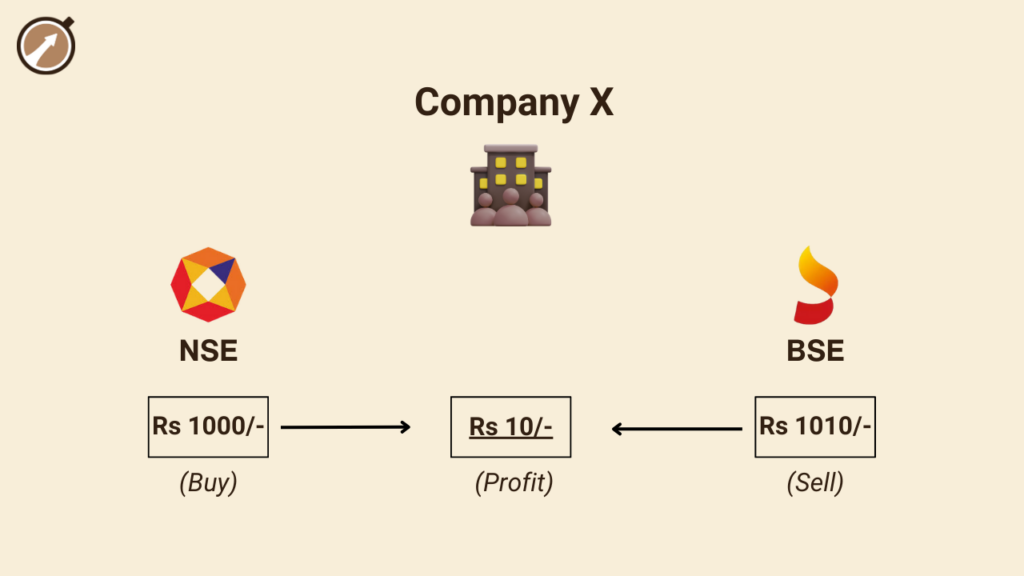

So, this technique involves making profits from the different stock prices on separate exchanges.

For example, if a stock from Company X is priced at Rs 1000 on the NSE and Rs 1010 on the BSE, these funds will buy the stock at the lower price on the NSE and simultaneously sell it at the higher price on the BSE.

This strategy, known as Exchange Arbitrage, allows them to secure a profit of Rs 10 per share.

Risk and Return Associated with Arbitrage Funds

Arbitrage funds aim to make a profit from the price difference of assets in different markets. Thus, the return generated by fund houses is not their own; instead, it is the result of the price difference between the cash and futures markets. Which also makes it a fixed-income instrument.

However, any security can’t be risk-free. Some sort of minimal risk will be associated with each security, same for arbitrage funds.

But there is some sort of credit risk associated with the Arbitrage Funds. Since Arbitrage funds are hybrid funds, some of their portions are allocated to debt securities like bonds, treasury bills, company paper, debt, etc.

Now let’s talk about returns of arbitrage funds. The return associated with the arbitrage fund varies with the volatility of the security market. You can see in our previous example of company X.

If the market gets consolidated and stagnant then arbitrage would give below-average returns due to less arbitrage opportunity.

Other things like transactional costs, statutory charges, and operating costs, can reduce the final returns for investors.

What are the Benefits of Investing in Arbitrage Funds?

- Steady Capital Appreciation: Bull market? Bear market? Doesn’t matter. Arbitrage funds tend to deliver steady cash flow through it all.

- Low Risk: Arbitrage funds jump in only when there’s a clear chance of making a profit from the difference in prices across two markets. So, they’re a safer bet.

- Lower Taxation: The tax benefits for arbitrage funds are quite attractive. These are considered equity funds since they mainly invest in stocks. So, if you keep your funds parked for less than a year, any amount above Rs. 1 lakh is taxed at only 15%, which is much lower than the rates for FDs, which can go up to 30%.

- Fixed Income: Arbitrage Funds make their gain spotting price gaps between the cash and futures markets. So, they manage to pull guaranteed profits. That’s why they are also known as fixed-income instruments.

Who Should Invest in Arbitrage Funds?

- Businesses: Businesses that have large amounts of idle funds in their current accounts should consider arbitrage funds for parking their idle funds to earn higher returns, without any significant market risk.

- Safety Seekers: People who seek a safer option for parking their funds, minimising risk exposure.

- Flexibility Seeker: People whose commitment periods are not too short nor too long, ideally somewhere between short to medium term.

- Liquidity Seekers: Those who value having quick and straightforward access to their parked funds.

And Finally, These are the Things to Keep in Mind

Before you put your money into Arbitrage Mutual Funds, think about these things:

- Fund Manager: How well the fund relies on whether the manager can spot and make money from the difference in prices.

- Costs: Just like any mutual fund, Arbitrage Funds come with fees. Try to pick funds with smaller fees to increase what you earn.

- Fund Size: Even though larger funds might have more resources, smaller funds could be better at spotting opportunities.

- Market Volatility: Arbitrage Funds usually do better when markets aren’t steady and there’s more variation in prices.

- Past Performance: It’s key to see how the fund did before, in both calm and rough market times. This includes its earnings, risk handling, and comparison to others. Remember, past success doesn’t promise future results, but it helps understand the fund’s management quality.

Final Thought

Mutual funds focused on arbitrage give you a special chance to invest. They mix low risk with the chance for steady gains.

These funds make profits by spotting and using price differences in the market. So, even though they’re different from usual fund parking avenues, they’re worth considering.

Yet, just like with any fund parking, you should look into it well and think about your money situation before putting your money in.

Did you find this information valuable? Share this blog with someone who is actively looking for steady capital appreciation instruments. Help them make informed financial decisions just as you do!

Don’t forget to subscribe to our blog for more valuable insights.

Was this helpful?

Click on a star to rate it!

As you found this post useful...

Follow us on social media!

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Ask us Anything!

Ask us Anything!